By: Percy Pierre, CFP, CLU, CHS

With tax season in full swing, advisors and clients are turning their attention to their annual filing. The governments of Canada and Ontario (as well as all the provinces) provide taxpayers with some tax relief in the form of tax credits which may be used to reduce income taxes payable. There are many such credits however I thought I would provide a list of some here as well as some of the annual limits that apply to specific programs.

LIMITS & EXEMPTIONS

Lifetime Capital Gains exemption: On the disposition of the shares of a Canadian Qualified Small Business Corporation the capital gains exemption in 2018 is $848,252. In 2019 the exemption will be $866,912. For qualified farm or fishing property there is an additional exemption of $151,748 in 2018 and $133,088 in 2019.

RRSP maximum contribution: The limit for 2018 is $26,230. For 2019 the limit will be $26,500

TFSA (Tax Free Savings Account): The 2018 contribution limit is $5,500 (total contribution limit to date from inception in 2009, is $57,500). In 2019 the limit will be $6,000.

OAS net income threshold: If net income in 2018 exceeds $75,910 their will be a clawback of 15% of the excess from OAS income to a maximum of the total OAS income received.

Maximum pensionable earnings: In 2018 the maximum is $55,900. In 2019 the maximum will be $57,400. In both years the basic exemption is $3,500.

Maximum EI earnings: The Federal maximum insurable earnings for 2018 is $51,700 and 2019 $53,100.

CREDITS*

GENERAL

- Basic Personal exemption: In 2018 the basic Federal personal amount is $11,809 and the Ontario amount is $10,354.

- Age amount: $7,333 may be claimed by individuals who are 65 or older on December 31st. The Ontario amount is $5,055. The income threshold for the age amount is $36,976 in 2018.

- Medical expenses: The lesser of 3% or $2,302 may be claimed in 2018 for eligible medical expenses. In 2019 the limit will be the lessor of 3% or $2,352.

- Spouse or common-law partner amount: The 2018 credit is $11,809. The Ontario amount is $8,792. In 2019 the credit will be $12,069.

- Amount for an eligible dependant: Single parents may be eligible to claim a maximum in 2018 of $11,809. The credit in 2019 will be $12,069.

- Pension income amount: If reporting eligible pension income or superannuation or annuity payments, $2.000 may be claimed. The Ontario amount is $1,432.

- Canada Child Benefit (base benefit for child under age 6): The 2018 credit is $6,496. In 2019 the credit will be $6,639. Phase out begins in 2018 at net family income of $30,450 and in 2019 at $31,120.

- Canada Child Benefit (base benefit for child aged 6 to 17): The 2018 credit is $5,481. In 2019 the credit will be $5,602. Phase out begins in 2018 at net family income of $30,450 and in 2019 at $31,120.>

CREDITS*

OF PARTICULAR RELEVANCE TO FAMILIES WITH DISABLED MEMBERS

- Canada caregiver amount for infirm children under age 18: $2,182 may be claimed by either parent (not both) for each infirm child born in 2001 or later and resides with both parents. Caregiver amount for dependant(s) age 18 or older: $6,986 may be claimed if the dependant’s net income for the year is $16,405 or less. If his or her net income is between $16,405 and $23,391 a partial claim can be made (Form TD1-WS)

- Ontario caregiver amount: If supporting an eligible infirm dependent (child, grandchild, parent, grandparent, sibling, aunt, uncle, niece or nephew) resident in Canada and aged 18 or older, complete Form TD1ON-WS

- Disability amount: The Federal amount is $8,235 if using Form T2201 Disability Tax Credit. The Ontario amount for 2018 is $8,365. A supplement of up to $4,804 may be claimed for children with disabilities.

- Child disability benefit: Up to $2,771 may be claimed for a severely impaired child under age 18. The benefit in 2019 will be $2,832.

*Source: Government of Canada Indexation adjustment for personal income tax and benefit amounts.

CHANGES COMING TO OW AND ODSP:

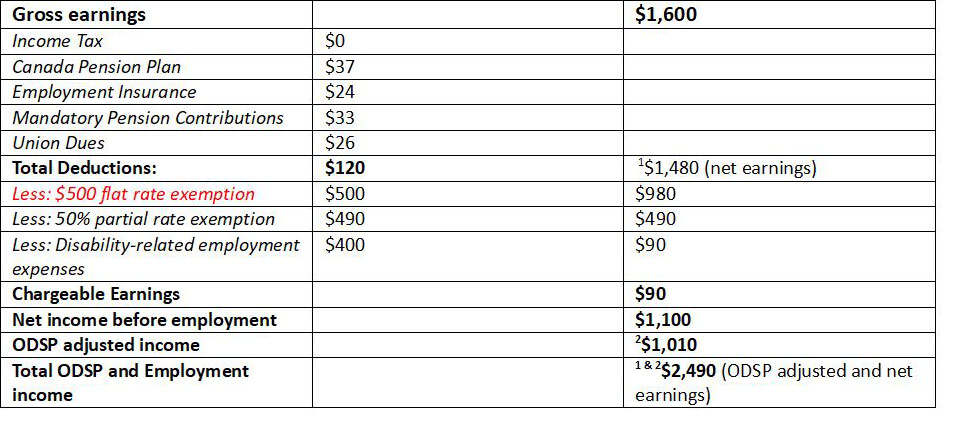

So far there is a change to the treatment of employment income for people receiving ODSP income benefits. The current $200 flat rate exemption is increased to $500.

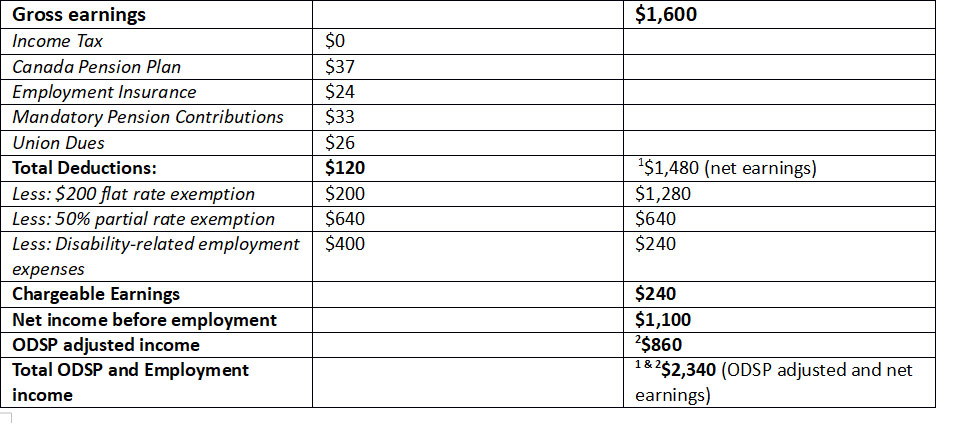

Consider the example of a recipient receiving $1,100 income benefit from ODSP, with gross earnings of $1,600, disability-related employment expenses of $400, CPP $37, EI $24, Mandatory pension contributions $33, and union dues $26

Currently

New

With the new change an individual receiving ODSP $1,100 income benefits who is mentally and physically able to perform part-time or full-time work paying $1,600 would increase his or her monthly income by $1,390 after accounting for the reduced ODSP income benefit.